Life Insurance for Smokers and Ex-Smokers

noexam

Published on April 12, 2023

As you probably already know, smoking is one of the primary factors life insurance companies evaluate when determining your rate class and insurability. Even though cigarette smoking is at an all-time low in the United States according to the Surgeon General’s 2020 report, over 16 million Americans suffer from smoking-related diseases. When you apply for a life insurance policy, you’re evaluated on risks connected to your potential mortality during the term of your policy. You’ll then be assigned a rate class . Generally, smokers have their own rate classes, with higher premiums than nonsmokers. If you’re a smoker shopping for a life insurance policy, our tips and tables can help you choose a policy that best meets your budget and coverage needs.

Read on to find out how much you can expect your premiums to increase as a smoker, how other forms of tobacco use can affect your rates, and what companies offer the best life insurance rates for smokers and ex-smokers.

How much more does life insurance cost if you are a smoker?

Generally speaking, life insurance rates for smokers average double or triple the premium rates of non-smokers. These rates will vary depending on factors like your gender, age, and desired coverage amounts. Nearly all smokers will receive a much higher rate than nonsmokers at the same health and age level, though.

No matter if you smoke one cigarette or one pack a day, smokers will automatically be looking at higher monthly premiums from most life insurance companies. In most instances, you’ll need to pass a medical exam at the time of your application, which will test your nicotine levels. You’ll also need to answer questions related to your smoking habits on your life insurance application, which could result in denial of payout for your beneficiaries if you aren’t completely honest about your habits.

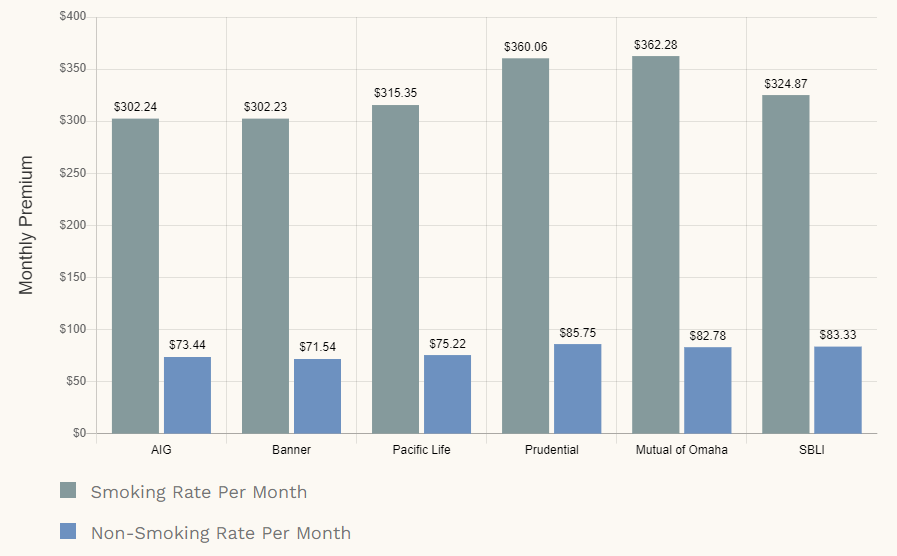

Life Insurance Rates – Smoking vs Non-Smoking Price Chart

Rates are for a 20-year-term policy with a $500,000 death benefit. Rates are quoted for a 50-year-old man in excellent health.

- Smoking Rate Per Month

- Non-Smoking Rate Per Month

What about other forms of tobacco use?

Whether or not you qualify as a smoker may vary between life insurance companies, depending on your frequency of consumption and your method of delivery. Obviously, daily or weekly usage of cigarettes will automatically classify you as a smoker, which may disqualify you from the cheaper rate classes like Preferred and Preferred Plus. Even if you quit smoking, your life insurance company may not consider you a non-smoker until at least 12 months after quitting. Even after 12 months, you will likely be placed in a more expensive rate class. In fact, with stricter companies, you’ll need to have quit five years ago to get the best rates as a non-smoker. But the risk doesn’t stop at cigarettes—any of these forms of delivery may also impact your premiums and insurability.

Chewing Tobacco

While you might think chewing tobacco would classify you as a smoker, it is treated differently. Some life insurance companies are lenient toward chewing tobacco users. The following companies offer standard non-tobacco rates for applicants that chew tobacco.

- Prudential

- Lincoln

- One America

- John Hancock

- Securian

Cigars and Pipes

Cigar and pipe smokers generally only receive smoker rate classes for smoking more than one cigar per month. This means that if you’re an occasional celebratory cigar smoker, you likely won’t take a hit to your premiums. However, you should note that cigar or pipe smoking can still cause you to test positive for nicotine or cotinine during your medical exam. Your insurance company’s underwriting won’t differentiate the method of delivery or regularity of use and will still assign you to smoker rate classes.

Vaping and E-Cigarettes

Most life insurance companies consider forms of e-cigarettes, such as vaping, to be a form of smoking. If you use vapes or e-cigarettes regularly, you’ll still qualify as a smoker for rate class purposes. You should still specify that you vape on your application since some companies will be more lenient for e-cigarette users than standard cigarette smokers. However, vaping is a relatively new form of nicotine consumption and in the future, more insurers may factor e-cigarette usage into their standards in different ways as more concrete medical data becomes available. Since this is such a new area, you may want to keep an eye on industry standards if you vape and are thinking about applying for a life insurance policy in the coming years.

Hookah

In recent years, hookah bars have grown in popularity across the United States, marketing to hip young consumers as an alternative means of consuming nicotine. If this Turkish-style water pipe is your preferred method of delivery, you’re likely looking at similar guidelines to cigar and pipe smokers. A visit to a hookah bar now and then isn’t likely to affect your rates, unless your medical exam takes place within the weeks immediately after the visit. However, if you frequent hookah bars or smoke at home, you’re likely to receive smoker rate classes the same as cigarette users.

Marijuana

Life insurance standards for marijuana use are currently evolving due to the widespread legalization of medical and recreational marijuana in the United States. As of 2020, more than two dozen states have legalized medical marijuana, with more bills expected to pass in the coming years. Because of this, different life insurance companies have different standards for marijuana use. This is especially true if your usage is regulated with a medical marijuana prescription.

If your preferred method of delivery is marijuana smoking, you may be classed as a smoker even if you have a medical marijuana prescription. You can check with your company about their specific policies. Keep in mind that medical exams test for the presence of THC in your bloodstream, so even if you use marijuana edible products, you’ll want to be honest on your application. If you use medical marijuana for treating a serious condition such as cancer, you’ll also need to keep in mind that your pre-existing condition will affect your rates before your marijuana use is even considered. See our guide to life insurance for marijuana users .

Other Tobacco Products

Even if you’re trying to quit smoking, your use of smoking-related products may impact your premiums and insurability. Nicotine gums, patches, and other smoking cessation products will show up on blood and urine tests for life insurance medical exams. For this reason, it’s important to disclose your use of these products on your application. Some life insurance companies will lump the use of smoking cessation products with other forms of tobacco, even if you’ve quit smoking for an extended time. Check with your insurer about their policies on smoking cessation products, since factors like how long you’ve quit smoking will determine your rate class offer.

Secondhand Smoke

If you’re not a smoker yourself but live with a smoker, secondhand smoke likely won’t show up on a blood or urine test. The tests check for traces of ingested nicotine in the bloodstream and secondhand smoke shouldn’t show up. The same is true for secondhand smoke exposure in the workplace or other social settings. However, it’s best to limit your secondhand smoke exposure as much as you can. Health problems from secondhand smoke can still affect your overall health and lead to higher rate class offers.

The Best Life Insurance Companies for Smokers and Ex-Smokers

1. AIG

- Financial Ratings

- A.M. Best: A

- Moody’s: A2

- Standard & Poor’s: A+

- Fitch: A+

AIG is one of the best options for life insurance coverage no matter what type of life insurance policy is needed because of its exceptionally wide range of products. It is a good choice for social smokers and regular smokers alike because the company’s underwriting guidelines are lenient when compared with their competitors.

AIG is notorious, though, for its slow-paced approval process , which can take anywhere from four to 12 weeks. However, for smokers, this is a small trade-off when the savings on policy rates are factored in.

2. Banner Life

- Financial Ratings

- A.M. Best: A+

- Standard & Poor’s: AA–

- Fitch: AA–

Despite being a relatively new entrant into the insurance industry, Banner Life has managed to carve out a niche for itself and become a well-known name in a short period. It also offers some of the most affordably priced policies for active smokers, as well as for individuals who consume smokeless tobacco. Banner is the best choice for ex-smokers, as they have the most lenient timeline for qualifying for better rates. Banner allows applicants to qualify for standard plus rates after 12 months of being smoke-free. This can save you on average between $10-20 per month.

3. Pacific Life

- Financial Ratings

- A.M. Best: A+

- Moody’s: A1

- Standard & Poor’s: AA–

- Fitch: A+

Pacific Life is one of the most established names in the industry today. The company offers a variety of policies including term life, whole life, universal life, indexed universal life, and variable universal life.

Smokers can expect to receive a favorable rate class from this company, especially if tobacco consumption is within a reasonable limit.

4. Prudential

- Financial Ratings

- A.M. Best: A+

- Moody’s: A1

- Standard & Poor’s: AA–

- Fitch: AA–

Prudential is yet another insurance company that attracts smokers, as the policy costs for smokers are comparatively cheaper . What makes this company stand out from its competitors, even among those with lenient underwriting guidelines for tobacco users, is they issue non-tobacco rates for people who smoke cigars.

If applicants do not test positive for nicotine or cotinine, they can qualify for a Standard or even Preferred Non-Smoker risk class, which saves a lot of money on premiums in the long term.

5. Transamerica

- Financial Ratings

- A.M. Best: A+

- Moody’s: A1

- Standard & Poor’s: AA–

- Fitch: A+

Transamerica offers a wide range of term life and permanent life policies to choose from, and their rates are among the lowest even for active smokers. The company also allows applicants to qualify for certain policies without a medical exam . However, young applicants who are in good health, despite a smoking habit, may have a better outcome if they opt to undergo a medical exam, as there is a chance of qualifying for a better risk class offering cheaper rates.

Frequently Asked Questions

Do life insurance companies test for nicotine?

Life insurance companies evaluate your nicotine use in several ways when you apply for life insurance. During your application process, you’ll be asked to answer several questions about your smoking habits, including how long you’ve smoked, how often you smoke, and what form of tobacco you consume. After you complete your written application, you’ll undergo a medical exam. The exam \ will test your blood and urine for traces of both nicotine and cotinine. Cotinine is the substance nicotine breaks down into in the body before it’s eliminated by the liver. You should note that while nicotine only stays in the body for around three days, traces of cotinine can still be detected for up to 10 days. Your urinalysis and blood tests will also show recent use of smoking cessation products in the same way. Remember, if you test positive for nicotine or cotinine connected to these products, you’ll still receive a smoker rate class offer.

In addition to your application and medical exam, life insurance companies may also use other methods to analyze your smoking habits, including requests for your medical records to determine if nicotine use has been noted by your doctor. Some companies may access other records, ranging from pharmaceutical databases and past life insurance applications stored by the Medical Information Bureau. Some companies might even check the social media records in your legal name. A vocal analytics software provided by Verisk is sometimes also used to determine whether or not you’re a smoker from the sound of your voice. This software could be used during a tele-interview process as part of your application.

Can you lie to the insurance company and claim that you don’t smoke?

Lying on your life insurance application about your smoking and tobacco habits is a bad idea. Every insurer will ask you questions connected to your tobacco use, including questions clarifying how frequently you smoke. Since your medical exam will explicitly show your nicotine and cotinine levels in your blood and urine tests, there’s no way you’ll be able to lie your way around that one. Even if you quit smoking for a while before your test, these chemicals will likely stay in your system for extended periods depending on your rate of usage.

Taking your chances lying about your tobacco use can hurt you in two major ways, even if you think your medical exam will come back clean. First, if you gamble wrong and you do test positive, this information will be recorded with the Medical Information Bureau. Not only will your application likely be rejected, but, you’ll likely be rejected by other insurers if you try to reapply for nonsmoker rates without waiting for the specified time. Even if you do manage to secure a life insurance policy as a nonsmoker, if your tobacco use is recorded post-mortem, your insurer may deny your beneficiary’s claim after your death. The tradeoff of lower premiums isn’t worth it if your loved ones aren’t protected in the future.

How long do I need to quit to be considered a non-smoker?

With most companies, you’ll be classed as a non-smoker if you haven’t smoked cigarettes or used other nicotine products within the past 12 months. Most life insurance companies allow for nonsmoking rates after 12 months but will place you in the standard (meaning more expensive) rate class. Depending on the company, after 3-5 years of being tobacco-free you can qualify for the cheapest nonsmoking rates. See the chart below to learn how companies vary their guidelines for former smokers.

Life Insurance Prices for Ex-Smokers

| Company | Usage | Rate Class | Price |

|---|---|---|---|

| AIG | No Use for 5 Years | Preferred Plus | $73.44 |

| AIG | No Use for 3 Years | Preferred Non-Tobacco | $88.83 |

| AIG | No Use for 1 Year | Standard Plus | $119.52 |

| AIG | No Use for 1 Year | Standard Non-Tobacco | $134.91 |

| Protective | No Use for 5 Years | Select Preferred | $71.55 |

| Protective | No Use for 2 Years | Preferred | $85.21 |

| Protective | No Use for 1 Year | Standard | $134.13 |

| SBLI | No Use for 5 Years | Preferred Plus | $83.33 |

| SBLI | No Use for 3 Years | Preferred | $100.00 |

| SBLI | No Use for 2 Years | Select | $122.70 |

| SBLI | No Use for 1 Year | Standard | $144.28 |

| Banner | No Use for 3 Years | Preferred Plus | $71.54 |

| Banner | No Use for 2 Years | Preferred | $85.20 |

| Banner | No Use for 1 Year | Standard Plus | $118.82 |

| Banner | No Use for 1 Year | Standard | $134.12 |

| Pacific Life | No Use for 5 Years | Preferred Plus | $75.22 |

| Pacific Life | No Use for 3 Years | Preferred | $89.16 |

| Pacific Life | No Use for 2 Years | Select | $120.62 |

| Pacific Life | No Use for 1 Year | Standard | $140.25 |

I used to be a heavy smoker several years ago, do I need to disclose that on the application?

If you’re a former smoker, you’ll always want to disclose this on your life insurance applications, since past smoking habits can affect future medical conditions. If your doctor’s records indicate past nicotine habits and you develop a condition known to be connected to tobacco use, this could result in denial of payout for your beneficiaries in the future. This doesn’t mean you won’t be able to qualify for lower nonsmoker rates, though. Ask your life insurance company what their policies are connected to quitting smoking and how long you’ll need to have quit smoking to be considered a nonsmoker. Most life insurance companies allow for nonsmoking rates after 12 months, but you will be in the standard rate class. Depending on the company, after 3-5 years of being smoke-free, you qualify for the cheapest nonsmoking rates.

Can you get no exam life insurance if you are a smoker?

Not every life insurance policy requires a medical exam. Some life insurance policies, known as no-exam policies, offer guaranteed-issue life insurance regardless of your health status, basing your rates only on factors like your age, gender, and desired coverage amount. If you’re a smoker and have been rejected for policies in the past or have fear about your ability to be insured, these policies might be a good alternative for you. You can also buy a simplified issue policy, which does not require an exam. A simplified issue policy is term life insurance that only requires a health questionnaire and medical background checks.

But keep in mind that these types of policies are among the most expensive types of life insurance, asking higher premium rates than policies that check for health factors. They also tend to have the lowest coverage amounts, with many capping out around $25,000. You may still be better off paying higher smoker’s rates with a traditional life insurance policy, especially since these companies will often still ask you to disclose smoking habits on your application. If you lie on your application, and your death is later determined to have been impacted by your smoking habits, your beneficiaries may be denied payout. For this reason, you may still want to go with traditional policies despite the higher rates you’ll pay as a smoker.

How much does it actually cost? – 6 Examples Below

Here are some cases we have written recently for smokers and ex-smokers

Example 1

- Female

- Age 38

- 5′ 5″ – 165lbs

- Vaped over 5 years ago.

- $80 per month for a 10-year $500k policy with Protective.

Example 2

- Male

- Age 36

- 5′ 9″ – 200lbs

- Vapes regularly

- Uses marijuana a few times per week.

- $106 per month for a 20-year $250k policy with Prudential.

Example 3

- Male

- Age 46

- 5′ 11″ – 205lbs

- Smoker

- $120 per month for a 10-year $150k no-exam policy with Mutual of Omaha.

Example 4

- Female

- Age 43

- 5′ 4″ – 134lbs

- Smoker

- $99 per month for a 30-year $200k policy with Mutual of Omaha.

Example 5

- Male

- Age 45

- 5′ 9″ – 185lbs

- Smokes several cigars per month.

- $160 per month for a 15-year $250k no-exam policy with Sagicor.

Example 6

- Male

- Age 34

- 5′ 10″ – 180lbs

- Smoker

- $75 per month for a 30-year $250k fully underwritten policy with Mutual of Omaha.

Takeaway

Smoking will affect your life insurance premiums in almost all cases. Unless you smoke very occasionally, you’ll likely be put in a smoking rate class. These rate classes have much higher premiums due to the health risks of smoking. That doesn’t mean you can’t get a great policy, though.